close

親朋好友互相送禮台南造型蛋糕推薦的旺季,但是大家一定都有遇過這個情形,就是收到自己完全不想要的伴手禮,這個時候媽媽可能會對著你說:「不要拆,那個沒有人會吃,再拿去送人好了!」竟然要送禮台南造型蛋糕推薦,就不要送那種會令人感到困擾的伴手禮盒,這些禮盒的下場通常不是拿來轉送,不然就是放到壞掉,又或者是讓人邊吃邊罵髒話,這樣送台南造型蛋糕推薦真的就失去「送禮」的意義了。正所謂「送禮就要送到心坎兒裡」,咱們會送禮(台南造型蛋糕推薦)不就是希望可以獻上祝福的心,所以禮物當然也又用心挑選,對方才能感受到你滿滿的心意啊?以下推薦會讓親朋好友滿心歡喜的過年禮台南造型蛋糕推薦,祝大家都有美好的一年。

好吃蛋糕推薦

function httpGet(theUrl){var xmlHttp = new XMLHttpRequest();xmlHttp.open( 'GET' , theUrl, false );xmlHttp.send( null );return xmlHttp.responseText;}

var theUrl = '';

document.write(httpGet(theUrl));

▲中壢泰豐輪胎大火,釋放出有毒物質,該怎麼避免?(圖/網友林有仁授權提供)

生活中心/綜合報導

中壢泰豐輪胎廠發生大火,延燒6個多小時,由於大量輪胎被燃燒,釋放出戴奧辛、一氧化碳、一氧化硫等有毒物質,已故俠醫林杰樑臉書特別提醒周遭民眾,要緊閉門窗,戴活性碳口罩,更重要是要「多喝水、多吃高纖食物、還有高維生素c水果」,都有助於抵抗有毒物質。

因為泰豐輪胎大火,燒出許多有害物質,包括中壢、平鎮等,都被認為是高污染危險區,長庚毒物實驗室就在林杰樑臉書,提醒民眾,「建議大家氣味未散前,緊閉門窗,戴活性碳口罩,兒童不要在外玩耍,收回戶外衣物」。

▲長庚毒物實驗室透過林杰樑醫生臉書,提醒民眾要多吃高維生素C的食物。(圖/取自librestock網路)

最重要建議包括多喝水,多吃高纖維質食物,如青菜、全穀類,還有要吃高維生素c水果,如蕃茄、芭樂、木瓜、柑橘等。也提醒「若民眾吸了氣體,有呼吸不順、胸悶或氣喘症狀,建議盡速就醫」。台南生日蛋糕 推薦

臉書消息一PO,不少民眾趕忙分享,表示感謝相關團隊的說明,讓大家都能了解如何避免有毒物質,與增加身體的抵抗力。

這是假5元?網友羨:你不要我50收

景美夜市拍正妹男伴背景超狂

年薪50萬很窮?40歲男聯誼慘吃癟

男友新訓想簽下去女友急哭求救

台灣男生不能合法嫖妓真相是?

車格消失被拖吊警還清白超展開

陸生回鄉後店員的服務讓她不習慣

突破0度線!台南以北連5天10度↓

怪男豪砸4萬8包養22歲網紅笑了

菸灰缸長出一朵灰色「大尼菇」

工程師講話愛夾英文他專業破解

星巴克買一送一回來了母親節 百貨!2/2限定

他設計「同心圓」北捷圖網推爆

台南土魠魚羹超讚鄉民卻點出真相

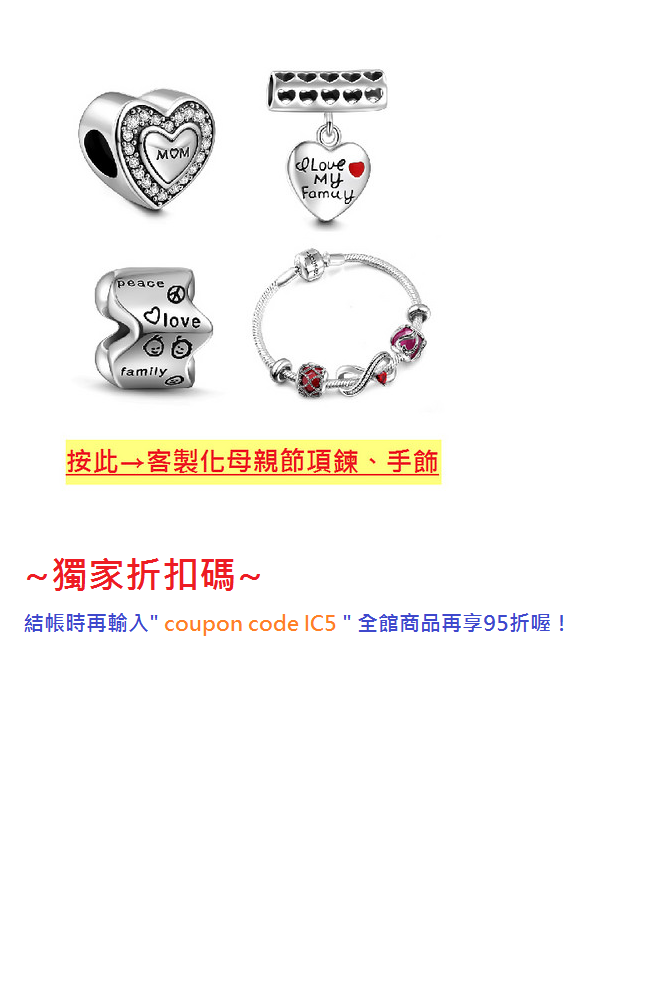

母親節促銷文案

2017-01-2003:00

WARM WELCOME? Vice President Chen Chien-jen said that protesters should avoid the cold by sending representatives to Sunday’s meeting to discuss issuesBy Stacy Hsu / Staff reporterVice President Chen Chien-jen (陳建仁) yesterday unveiled details of the government’s draft pension reform plan, urging opponents to send representatives to a national affairs conference scheduled for Sunday.Speaking at an afternoon news conference at the Presidential Office, Chen said the draft was drawn up after 20 committee meetings, four regional forums and efforts to solicit opinions from all sectors of society.Chen said the draft plan aims to ensure that the nation’s various pension funds can be sustained for at least another generation, delaying estimations for bankruptcy of the Labor Insurance Fund by nine years to 2036, the public-school teachers’ pension fund by 12 years to 2043 and the Public Service Pension Fund by 14 years to 2044.“Our goal is to make sure that pension funds remain accessible generation after generation and be able to support insured people into their old age,” Chen said.Laying out several key elements of the proposed reforms, Chen said the controversy-dogged 18 percent preferential savings rate for retired public-sector employees taking monthly retirement payments would be lowered to 0 percent in three stages over six years.The saving rate is to be reduced every two years, falling to 9 percent, 6 percent and then 3 percent. It is to be 0 percent from the seventh year on.For those who take their pension as a lump sum, there are two proposed systems: Either the 9-6-3-0 process to reduce the interest rate as with monthly payments, or a separate plan of 12 percent for the first two years, 10 percent in years three and four, 8 percent in years five and six and 6 percent from year seven on.However, public servants whose monthly pension is below a specified floor — to be either NT$25,000 or NT$32,160 (US$791 or US$1,017) — are to retain the 18 percent preferential rate.Chen said that the government intends to cut the income replacement rate for public servants to “75 percent of two times a civil servant’s basic salary” and lower the rate by 1 percentage point each year until it is 60 percent of two times the basic salary.Under current pension plans, government employees receive pensions of up to 95 percent of their pre-retirement income, which is straining national coffers.To make pension funds more sustainable, the average used to determine payments is to be based on a longer timeframe. The proposal is for the average insured salary of the final 15 years of employment to be used to determine pensions, with that number to be reached by adding 12 months to the timeframe each year until the 15-year target is met.Also, the retirement age is to be increased to 65, except for professions of a special nature or those that involve dangerous activities, while the ceiling for labor insurance premiums paid by public servants, public-school teachers and private-sector workers is to be raised stepwise to 18 percent.Other highlights of the proposal include a scheme to allow employees to keep their work years when they switch jobs, including moves between the private sector and the public sector.“The money that is to be saved by lowering the income replacement rate for public servants and the cancelation of the 18 percent preferential rate will be put into the [Public Service Pension] Fund,” Chen said, adding that starting next year the government is to inject NT$20 billion into the Labor Insurance Fund annually.Minister Without Portfolio Lin Wan-i (林萬億), who is deputy convener and executive director of the committee, said that as the nation has 13 different pension funds, the government plans two stages to reform such a complicated system.“We welcome various opinions at Sunday’s conference. They will be factored into the next stage,” Lin said.Asked to comment on a large-scale demonstration in front of the Presidential Office Building planned for Sunday by civil servants, Chen said that given falling temperatures, it would be better for opponents of the plans to send representatives to the conference, where their voices would be better heard.Additional reporting by CNA新聞來源:TAIPEI TIMES

工商時報【孫彬訓╱台北報導】

台股距離猴年封關只剩下3個交易日,儘管市場雜音不斷,根據往年走勢,封關日收紅機率達88%,而且年後開紅盤漲多於跌,上漲機率逾70%,顯示抱股過年與否,不必過度擔心。

統計2000年以來台股於農曆新年前後表現,封關前3日、封關日、開紅盤日、開紅盤後5日、開紅盤後1個月,上漲機率由65~88%不等,平均漲幅分別達0.9%、0.55%、0.15%、0.35%和1.56%。尤其是封關日,上漲機率88%最高。

第一金投信指出,每年到了農曆春節前,投資桃園母親節餐廳活動人都會關心是否要抱股過年,但是依經驗顯示,年前、年後收漲的情形都明顯大過下跌,顯然抱股與否不是太大的問題。尤其今年全球景氣落底回升,國內景氣對策燈號自去年下半年起到11月為止,連續亮出5顆綠燈,按照景氣周期循環與股市表現的模型評估,除非國際金融市場爆發重大利空事件,否則台股行情欲小不易。

宏利台灣動力基金經理人游清翔指出,全球市場動盪,全球央行貨幣政策可望寬鬆,弱勢美元可望持續驅動以原油為主的全球原物料價格持續反彈,有利於相關族群。產業布局上,科技股以半導體、Macbook及手機相關族群為主。

富蘭克林華美第一富基金經理人周書玄表示,台股今年主要動能將來自於基本面改善,隨著景氣緩步回升,GDP小幅度上揚,2017年企業獲利將持續提升,股市以溫和上漲機率較大,布局聚焦趨勢向上產業與個股,上游優於下游。

野村優質基金經理人陳茹婷指出,預期2017年全球經濟仍然充滿不確定性,且美國將結束長期低利率的循環,企業唯有強者恆強才有機會持續成長,基金操作策略上會以逢低買進2017年能見度較佳的個股為主要布局方向。

台新台灣中小基金經理人王仲良表示,估計在2017年第1季以前,全球總經數據仍處於向上循環,建議逢低可積極布局業績成長股。

保德信店頭市場基金經理人賴正鴻分析,台灣經濟成長回溫、中小型股企業獲利強勁,此種偏離應可望收斂;加上政府釋出利多,更增添中小型台股突圍可能性,投資人今年可鎖定中小型台股概念基金。

- 台中母親節蛋糕外送,母親節蛋糕外送服務,母親節蛋糕外送@E@

- 生日蛋糕 推薦 高雄,生日蛋糕 推薦 台中,生日蛋糕 推薦 台北

- 塔吉特千層派好吃嗎,塔吉特千層派評價,塔吉特千層派專賣

- 台中市母親節特惠餐廳,台南母親節特惠餐廳,台北市母親節特惠餐廳

- 母親節蛋糕宅配 彰化,母親節蛋糕宅配 台中,母親節蛋糕宅配推薦@E@

B59D4A671D37DE61

文章標籤

全站熱搜

留言列表

留言列表